5 Combining sign and zero restrictions

Sometimes we need to combine different types of restrictions. For instance:

- One shock satisfies both zero and sign restrictions.

- Some shocks can be identified with zero restrictions (SR or LR), others with sign restrictions.

- Some shocks satisfy the same zero restrictions (e.g. no LR effect on output) but can be distinguished from each other through sign restrictions.

In such instances, we must make independent draws from the set of all structural parameters satisfying the zero restrictions. How to do that? Arias, Rubio-Ramírez, and Waggoner (2018) propose to impose the zero restrictions on \(B\), and then check signs. Remember, \(\mathcal{P}=BQ\) is a candidate impact IRF. For each structural shock \(j\), define the \(m\)-column matrices \(Z_j\) (zero restrictions) and \(S_j\) (sign restrictions). Each row of \(Z_j\) (resp. \(S_j\)) defines a zero (resp. sign) restriction. \(Z_j\) has \(m-j\) rows at most (i.e., \(m-j\) zero restriction at most).

Example 5.1 In a 4-variable VAR, we want to impose that the first structural shock has no effect on variable 1, affects positively variable 2 and negatively variable 3 on impact: \[Z_1 = \begin{pmatrix}1 & 0 & 0 & 0\end{pmatrix}, \] \[S_1 = \begin{pmatrix}0 & 1 & 0 & 0\\ 0 & 0 & -1 & 0\end{pmatrix}. \]

For both zero and sign restrictions to be satisfied, we must have \[ Z_jb_j=0 \quad \mbox{and} \quad S_jb_j>0, \] where \(b_j\) is the \(j^{th}\) column of \(B\), i.e. the impact effect of the \(j^{th}\) structural shock.

The algorithm is as follows:

- For \(1\le j\le m\), draw \(u_j\in \mathbb{R}^{m+1-j-z_j}\) from a standard normal distribution (\(z_j\) is the number of zero restrictions imposed on the \(j^{th}\) shock) and set \(w_j = u_j/||u_j||\).

- Define \(Q= \begin{pmatrix}q_1&...&q_m\end{pmatrix}\) recursively by \(q_j = K_jw_j\) for any matrix \(K_j\) whose columns form an orthogonal basis for the null space of the matrix \[M_j = \begin{pmatrix} q_1&...&q_{j-1}&\color{blue}{(Z_jP)'}\end{pmatrix}'.\] (Vector \(q_j\) will then be orthogonal to \(\begin{pmatrix} q_1&...&q_{j-1}\end{pmatrix}\) and satisfy the zero restriction.)

- Set \(B=PQ\).

- Check sign restrictions (\(S_jb_j>0\) for all \(j\)?).

Perform \(N\) replications and report the median impulse response (and its confidence intervals).

Function svar.signs can run this algorithm. It is called as follows:10

library(IdSS);library(vars);library(Matrix)

data("USmonthly")

First.date <- "1965-01-01"

Last.date <- "1995-06-01"

indic.first <- which(USmonthly$DATES==First.date)

indic.last <- which(USmonthly$DATES==Last.date)

USmonthly <- USmonthly[indic.first:indic.last,]

considered.variables<-c("LIP","UNEMP","LCPI","LPCOM","FFR","NBR","TTR","M1")

n <- length(considered.variables)

y <- as.matrix(USmonthly[considered.variables])

sign.restrictions <- list()

SR.restrictions <- list()

horizon <- list()

#Define sign restrictions and horizon for restrictions

for(i in 1:n){

sign.restrictions[[i]] <- matrix(0,n,n)

horizon[[i]] <- 1

}

# 2 shocks on the demand for reserves

sign.restrictions[[1]][1,6] <- 1

sign.restrictions[[2]][1,7] <- 1

# 3 shocks that drive an endogenous response of the interest rate

sign.restrictions[[3]][1,1] <- 1

sign.restrictions[[3]][2,5] <- 1

sign.restrictions[[4]][1,2] <- -1

sign.restrictions[[4]][2,5] <- 1

sign.restrictions[[5]][1,3] <- 1

sign.restrictions[[5]][2,5] <- 1

# monetary policy shock

sign.restrictions[[6]][1,5] <- -1

sign.restrictions[[6]][2,3] <- 1

sign.restrictions[[6]][3,6] <- 1

# horizon for sign restrictions on monetary policy shock

horizon[[6]] <- 1:5

#Define zero restrictions

# 2 shocks on the demand for reserves

SR.restrictions[[1]] <- array(0,c(1,n))

SR.restrictions[[1]][1,5] <- 1 # no impact on the interest rate

SR.restrictions[[2]] <- array(0,c(1,n))

SR.restrictions[[2]][1,5] <- 1 # no impact on the interest rate

for(i in 3:n){

SR.restrictions[[i]] <- array(0,c(0,n))

}

res.svar.signs.zeros <- svar.signs(y,p=3,

nb.shocks = 6, #number of identified shocks

nb.periods.IRF = 20,

bootstrap.replications = 100, # = 1 if no bootstrap, = N if bootstrap

confidence.interval = 0.90, # expressed in pp.

indic.plot = 1, # Plots are displayed if = 1.

nb.draws = 10000, # number of draws

sign.restrictions,

horizon,

recursive =0,

SR.restrictions

)

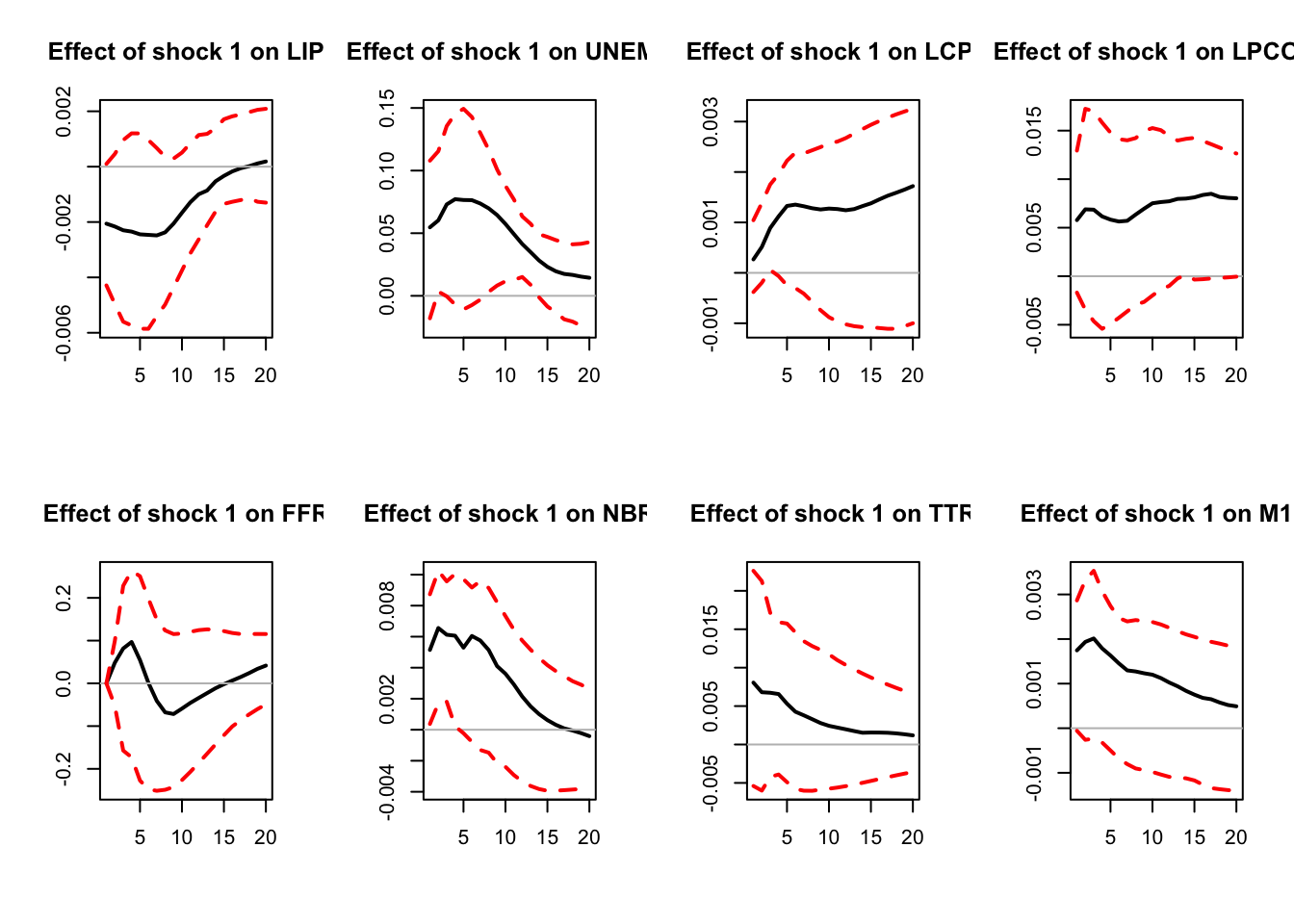

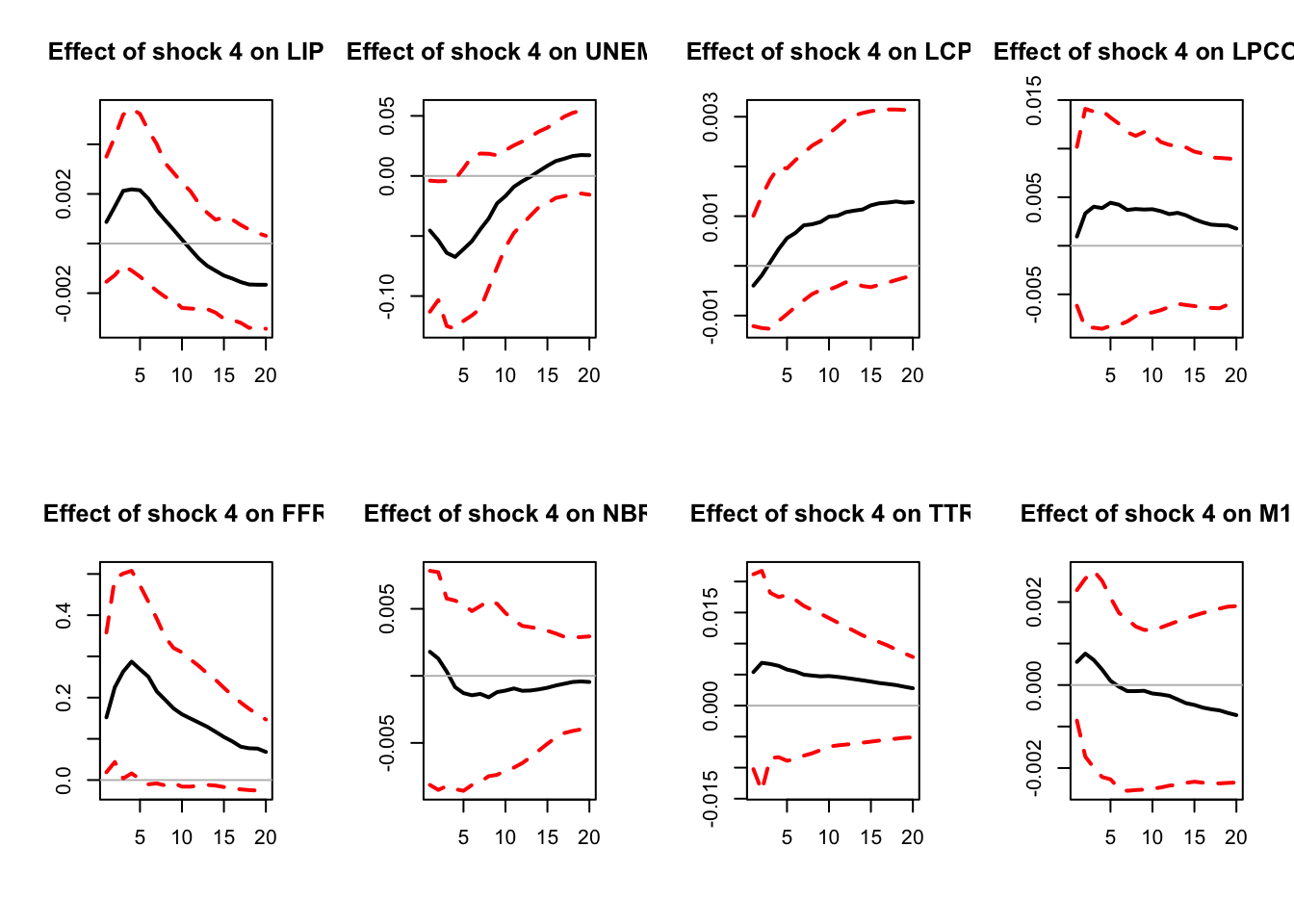

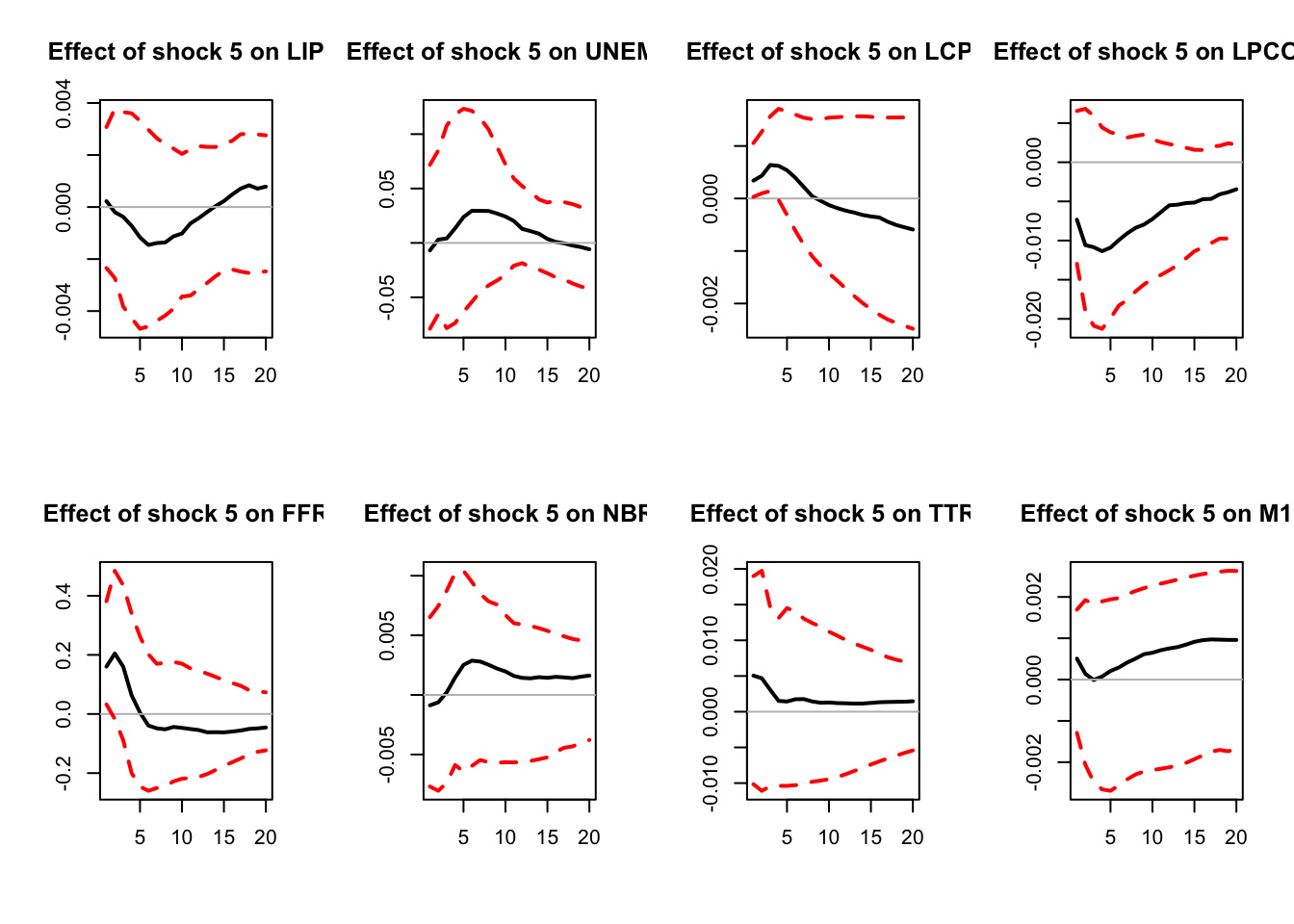

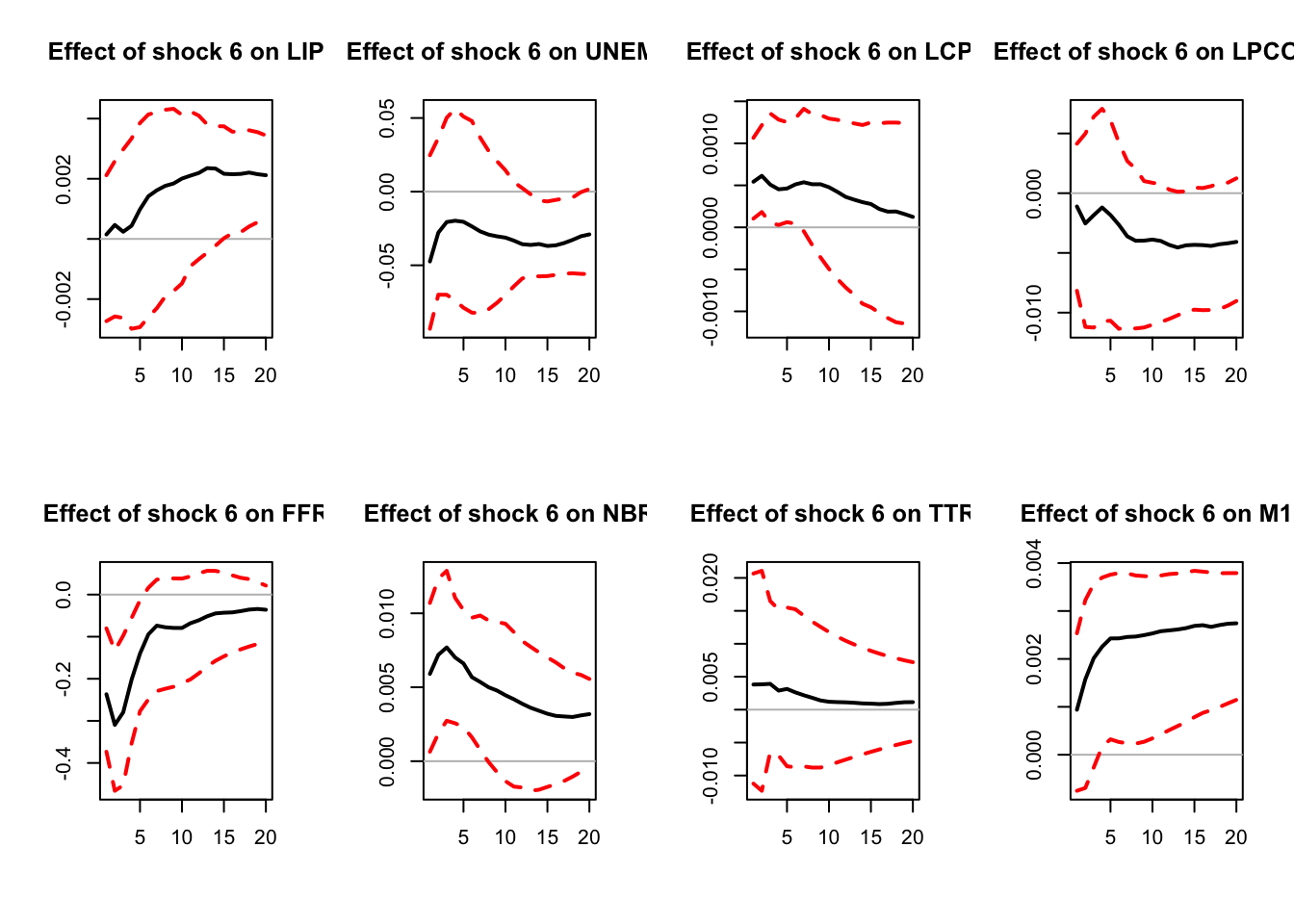

Figure 5.1: IRFs; sign-restriction approach.

Figure 5.2: IRFs; sign-restriction approach.

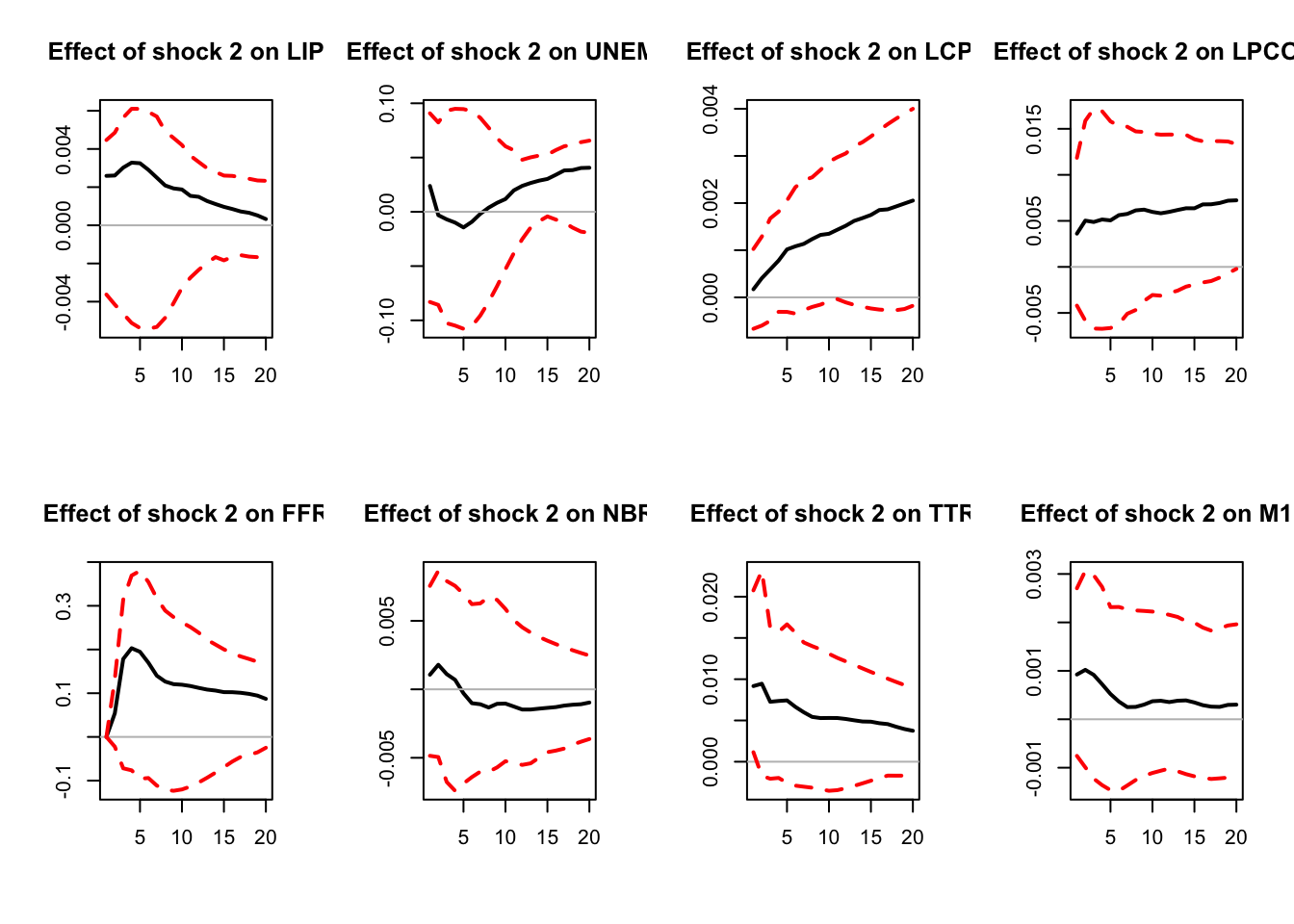

Figure 5.3: IRFs; sign-restriction approach.

Figure 5.4: IRFs; sign-restriction approach.

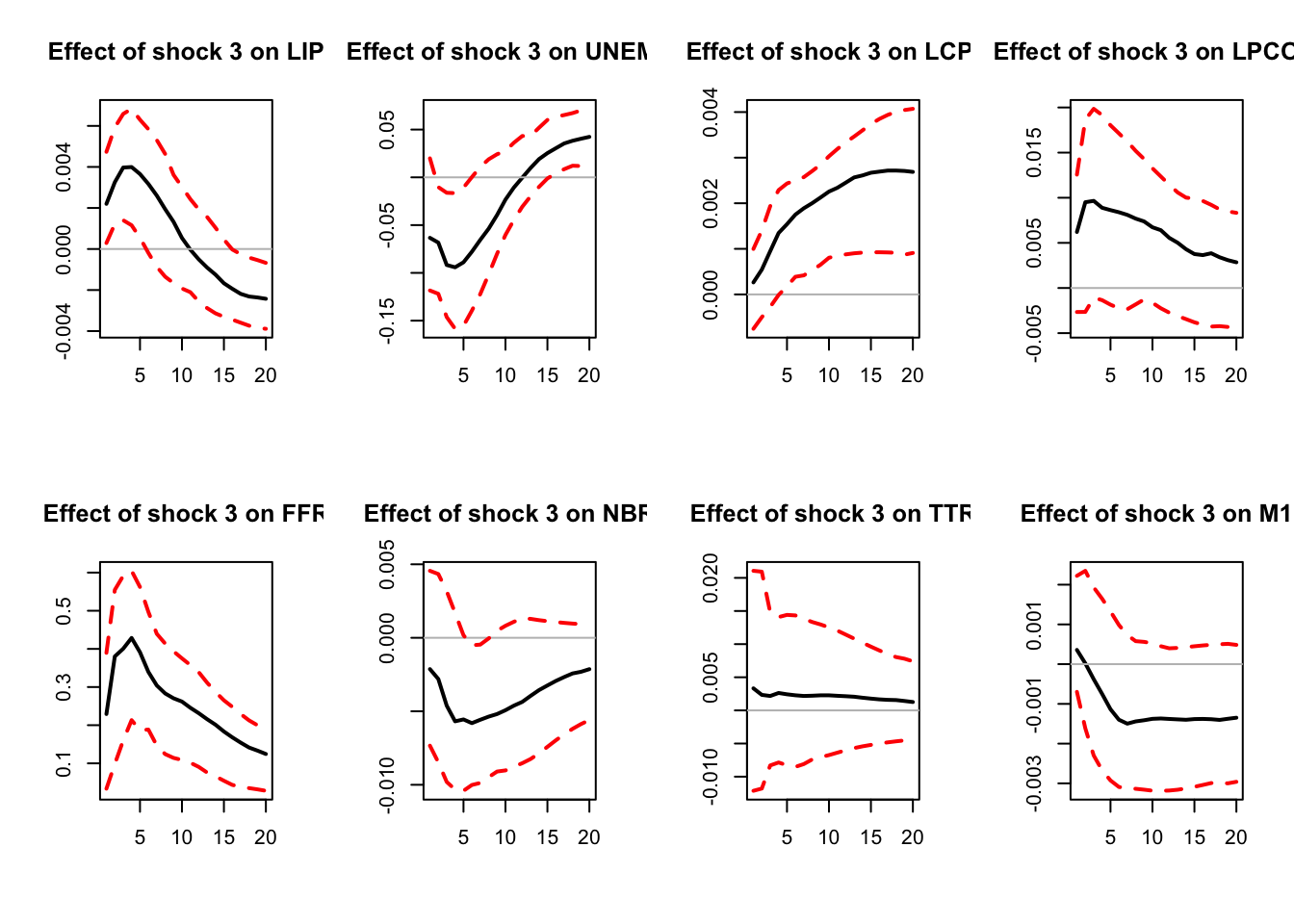

Figure 5.5: IRFs; sign-restriction approach.

Figure 5.6: IRFs; sign-restriction approach.

# Output

IRFs.signs <- res.svar.signs.zeros$IRFs.signs # all the simulated IRFs

nb.rotations <- res.svar.signs.zeros$xx # total number of rotations

all.CI.median <- res.svar.signs.zeros$all.CI.median # median IRFs for the selected shocks

all.CI.lower.bounds <- res.svar.signs.zeros$all.CI.lower.bounds # lower-bound IRFs for the selected shocks

all.CI.upper.bounds <- res.svar.signs.zeros$all.CI.upper.bounds # upper-bound IRFs for the selected shocks