8 Appendix

8.1 Principal component analysis (PCA)

Principal component analysis (PCA) is a classical and easy-to-use statistical method to reduce the dimension of large datasets containing variables that are linearly driven by a relatively small number of factors. This approach is widely used in data analysis and image compression.

Suppose that we have \(T\) observations of a \(n\)-dimensional random vector \(x\), denoted by \(x_{1},x_{2},\ldots,x_{T}\). We suppose that each component of \(x\) is of mean zero.

Let denote with \(X\) the matrix given by \(\left[\begin{array}{cccc} x_{1} & x_{2} & \ldots & x_{T}\end{array}\right]'\). Denote the \(j^{th}\) column of \(X\) by \(X_{j}\).

We want to find the linear combination of the \(x_{i}\)’s (\(x.u\)), with \(\left\Vert u\right\Vert =1\), with “maximum variance.” That is, we want to solve: \[\begin{equation} \begin{array}{clll} \underset{u}{\arg\max} & u'X'Xu. \\ \mbox{s.t. } & \left\Vert u \right\Vert =1 \end{array}\tag{8.1} \end{equation}\]

Since \(X'X\) is a positive definite matrix, it admits the following decomposition: \[\begin{eqnarray*} X'X & = & PDP'\\ & = & P\left[\begin{array}{ccc} \lambda_{1}\\ & \ddots\\ & & \lambda_{n} \end{array}\right]P', \end{eqnarray*}\] where \(P\) is an orthogonal matrix whose columns are the eigenvectors of \(X'X\).

We can order the eigenvalues such that \(\lambda_{1}\geq\ldots\geq\lambda_{n}\). (Since \(X'X\) is positive definite, all these eigenvalues are positive.)

Since \(P\) is orthogonal, we have \(u'X'Xu=u'PDP'u=y'Dy\) where \(\left\Vert y\right\Vert =1\). Therefore, we have \(y_{i}^{2}\leq 1\) for any \(i\leq n\).

As a consequence: \[ y'Dy=\sum_{i=1}^{n}y_{i}^{2}\lambda_{i}\leq\lambda_{1}\sum_{i=1}^{n}y_{i}^{2}=\lambda_{1}. \]

It is easily seen that the maximum is reached for \(y=\left[1,0,\cdots,0\right]'\). Therefore, the maximum of the optimization program (Eq. (8.1)) is obtained for \(u=P\left[1,0,\cdots,0\right]'\). That is, \(u\) is the eigenvector of \(X'X\) that is associated with its larger eigenvalue (first column of \(P\)).

Let us denote with \(F\) the vector that is given by the matrix product \(XP\). The columns of \(F\), denoted by \(F_{j}\), are called factors. We have: \[ F'F=P'X'XP=D. \] Therefore, in particular, the \(F_{j}\)’s are orthogonal.

Since \(X=FP'\), the \(X_{j}\)’s are linear combinations of the factors. Let us then denote with \(\hat{X}_{i,j}\) the part of \(X_{i}\) that is explained by factor \(F_{j}\), we have: \[\begin{eqnarray*} \hat{X}_{i,j} & = & p_{ij}F_{j}\\ X_{i} & = & \sum_{j}\hat{X}_{i,j}=\sum_{j}p_{ij}F_{j}. \end{eqnarray*}\]

Consider the share of variance that is explained—through the \(n\) variables (\(X_{1},\ldots,X_{n}\))—by the first factor \(F_{1}\): \[\begin{eqnarray*} \frac{\sum_{i}\hat{X}'_{i,1}\hat{X}_{i,1}}{\sum_{i}X_{i}'X_{i}} & = & \frac{\sum_{i}p_{i1}F'_{1}F_{1}p_{i1}}{tr(X'X)} = \frac{\sum_{i}p_{i1}^{2}\lambda_{1}}{tr(X'X)} = \frac{\lambda_{1}}{\sum_{i}\lambda_{i}}. \end{eqnarray*}\]

Intuitively, if the first eigenvalue is large, it means that the first factor captures a large share of the fluctutaions of the \(n\) \(X_{i}\)’s.

By the same token, it is easily seen that the fraction of the variance of the \(n\) variables that is explained by factor \(j\) is given by: \[\begin{eqnarray*} \frac{\sum_{i}\hat{X}'_{i,j}\hat{X}_{i,j}}{\sum_{i}X_{i}'X_{i}} & = & \frac{\lambda_{j}}{\sum_{i}\lambda_{i}}. \end{eqnarray*}\]

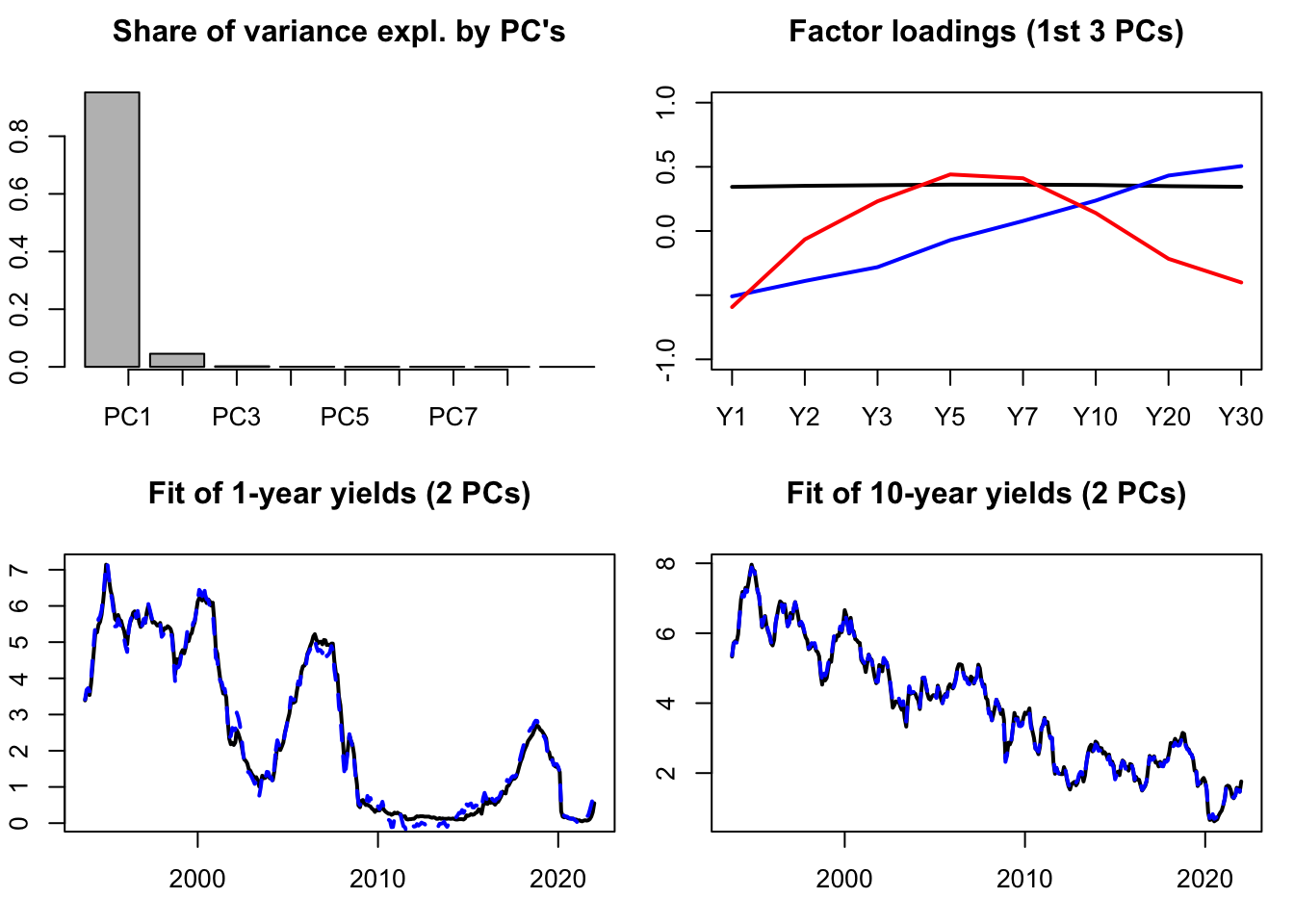

Let us illustrate PCA on the term structure of yields. The term strucutre of yields (or yield curve) is know to be driven by only a small number of factors (e.g., Litterman and Scheinkman (1991)). One can typically employ PCA to recover such factors. The data used in the example below are taken from the Fred database (tickers: “DGS6MO”,“DGS1”, …). The second plot shows the factor loardings, that indicate that the first factor is a level factor (loadings = black line), the second factor is a slope factor (loadings = blue line), the third factor is a curvature factor (loadings = red line).

To run a PCA, one simply has to apply function prcomp to a matrix of data:

library(AEC)

USyields <- USyields[complete.cases(USyields),]

yds <- USyields[c("Y1","Y2","Y3","Y5","Y7","Y10","Y20","Y30")]

PCA.yds <- prcomp(yds,center=TRUE,scale. = TRUE)Let us know visualize some results. The first plot of Figure 8.1 shows the share of total variance explained by the different principal components (PCs). The second plot shows the factor loadings. The two bottom plots show how yields (in black) are fitted by linear combinations of the first two PCs only.

par(mfrow=c(2,2))

par(plt=c(.1,.95,.2,.8))

barplot(PCA.yds$sdev^2/sum(PCA.yds$sdev^2),

main="Share of variance expl. by PC's")

axis(1, at=1:dim(yds)[2], labels=colnames(PCA.yds$x))

nb.PC <- 2

plot(-PCA.yds$rotation[,1],type="l",lwd=2,ylim=c(-1,1),

main="Factor loadings (1st 3 PCs)",xaxt="n",xlab="")

axis(1, at=1:dim(yds)[2], labels=colnames(yds))

lines(PCA.yds$rotation[,2],type="l",lwd=2,col="blue")

lines(PCA.yds$rotation[,3],type="l",lwd=2,col="red")

Y1.hat <- PCA.yds$x[,1:nb.PC] %*% PCA.yds$rotation["Y1",1:2]

Y1.hat <- mean(USyields$Y1) + sd(USyields$Y1) * Y1.hat

plot(USyields$date,USyields$Y1,type="l",lwd=2,

main="Fit of 1-year yields (2 PCs)",

ylab="Obs (black) / Fitted by 2PCs (dashed blue)")

lines(USyields$date,Y1.hat,col="blue",lty=2,lwd=2)

Y10.hat <- PCA.yds$x[,1:nb.PC] %*% PCA.yds$rotation["Y10",1:2]

Y10.hat <- mean(USyields$Y10) + sd(USyields$Y10) * Y10.hat

plot(USyields$date,USyields$Y10,type="l",lwd=2,

main="Fit of 10-year yields (2 PCs)",

ylab="Obs (black) / Fitted by 2PCs (dashed blue)")

lines(USyields$date,Y10.hat,col="blue",lty=2,lwd=2)

Figure 8.1: Some PCA results. The dataset contains 8 time series of U.S. interest rates of different maturities.

8.2 Linear algebra: definitions and results

Definition 8.1 (Eigenvalues) The eigenvalues of of a matrix \(M\) are the numbers \(\lambda\) for which: \[ |M - \lambda I| = 0, \] where \(| \bullet |\) is the determinant operator.

Proposition 8.1 (Properties of the determinant) We have:

- \(|MN|=|M|\times|N|\).

- \(|M^{-1}|=|M|^{-1}\).

- If \(M\) admits the diagonal representation \(M=TDT^{-1}\), where \(D\) is a diagonal matrix whose diagonal entries are \(\{\lambda_i\}_{i=1,\dots,n}\), then: \[ |M - \lambda I |=\prod_{i=1}^n (\lambda_i - \lambda). \]

Definition 8.2 (Moore-Penrose inverse) If \(M \in \mathbb{R}^{m \times n}\), then its Moore-Penrose pseudo inverse (exists and) is the unique matrix \(M^* \in \mathbb{R}^{n \times m}\) that satisfies:

- \(M M^* M = M\)

- \(M^* M M^* = M^*\)

- \((M M^*)'=M M^*\) .iv \((M^* M)'=M^* M\).

Proposition 8.2 (Properties of the Moore-Penrose inverse)

- If \(M\) is invertible then \(M^* = M^{-1}\).

- The pseudo-inverse of a zero matrix is its transpose. * The pseudo-inverse of the pseudo-inverse is the original matrix.

Definition 8.3 (Idempotent matrix) Matrix \(M\) is idempotent if \(M^2=M\).

If \(M\) is a symmetric idempotent matrix, then \(M'M=M\).

Proposition 8.3 (Roots of an idempotent matrix) The eigenvalues of an idempotent matrix are either 1 or 0.

Proof. If \(\lambda\) is an eigenvalue of an idempotent matrix \(M\) then \(\exists x \ne 0\) s.t. \(Mx=\lambda x\). Hence \(M^2x=\lambda M x \Rightarrow (1-\lambda)Mx=0\). Either all element of \(Mx\) are zero, in which case \(\lambda=0\) or at least one element of \(Mx\) is nonzero, in which case \(\lambda=1\).

Proposition 8.4 (Idempotent matrix and chi-square distribution) The rank of a symmetric idempotent matrix is equal to its trace.

Proof. The result follows from Prop. 8.3, combined with the fact that the rank of a symmetric matrix is equal to the number of its nonzero eigenvalues.

Proposition 8.5 (Constrained least squares) The solution of the following optimisation problem: \[\begin{eqnarray*} \underset{\boldsymbol\beta}{\min} && || \mathbf{y} - \mathbf{X}\boldsymbol\beta ||^2 \\ && \mbox{subject to } \mathbf{R}\boldsymbol\beta = \mathbf{q} \end{eqnarray*}\] is given by: \[ \boxed{\boldsymbol\beta^r = \boldsymbol\beta_0 - (\mathbf{X}'\mathbf{X})^{-1} \mathbf{R}'\{\mathbf{R}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{R}'\}^{-1}(\mathbf{R}\boldsymbol\beta_0 - \mathbf{q}),} \] where \(\boldsymbol\beta_0=(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}'\mathbf{y}\).

Proof. See for instance Jackman, 2007.

Proposition 8.6 (Inverse of a partitioned matrix) We have: \[\begin{eqnarray*} &&\left[ \begin{array}{cc} \mathbf{A}_{11} & \mathbf{A}_{12} \\ \mathbf{A}_{21} & \mathbf{A}_{22} \end{array}\right]^{-1} = \\ &&\left[ \begin{array}{cc} (\mathbf{A}_{11} - \mathbf{A}_{12}\mathbf{A}_{22}^{-1}\mathbf{A}_{21})^{-1} & - \mathbf{A}_{11}^{-1}\mathbf{A}_{12}(\mathbf{A}_{22} - \mathbf{A}_{21}\mathbf{A}_{11}^{-1}\mathbf{A}_{12})^{-1} \\ -(\mathbf{A}_{22} - \mathbf{A}_{21}\mathbf{A}_{11}^{-1}\mathbf{A}_{12})^{-1}\mathbf{A}_{21}\mathbf{A}_{11}^{-1} & (\mathbf{A}_{22} - \mathbf{A}_{21}\mathbf{A}_{11}^{-1}\mathbf{A}_{12})^{-1} \end{array} \right]. \end{eqnarray*}\]

Definition 8.4 (Matrix derivatives) Consider a fonction \(f: \mathbb{R}^K \rightarrow \mathbb{R}\). Its first-order derivative is: \[ \frac{\partial f}{\partial \mathbf{b}}(\mathbf{b}) = \left[\begin{array}{c} \frac{\partial f}{\partial b_1}(\mathbf{b})\\ \vdots\\ \frac{\partial f}{\partial b_K}(\mathbf{b}) \end{array} \right]. \] We use the notation: \[ \frac{\partial f}{\partial \mathbf{b}'}(\mathbf{b}) = \left(\frac{\partial f}{\partial \mathbf{b}}(\mathbf{b})\right)'. \]

Proposition 8.7 We have:

- If \(f(\mathbf{b}) = A' \mathbf{b}\) where \(A\) is a \(K \times 1\) vector then \(\frac{\partial f}{\partial \mathbf{b}}(\mathbf{b}) = A\).

- If \(f(\mathbf{b}) = \mathbf{b}'A\mathbf{b}\) where \(A\) is a \(K \times K\) matrix, then \(\frac{\partial f}{\partial \mathbf{b}}(\mathbf{b}) = 2A\mathbf{b}\).

Proposition 8.8 (Square and absolute summability) We have: \[ \underbrace{\sum_{i=0}^{\infty}|\theta_i| < + \infty}_{\mbox{Absolute summability}} \Rightarrow \underbrace{\sum_{i=0}^{\infty} \theta_i^2 < + \infty}_{\mbox{Square summability}}. \]

Proof. See Appendix 3.A in Hamilton. Idea: Absolute summability implies that there exist \(N\) such that, for \(j>N\), \(|\theta_j| < 1\) (deduced from Cauchy criterion, Theorem 8.2 and therefore \(\theta_j^2 < |\theta_j|\).

8.3 Statistical analysis: definitions and results

8.3.1 Moments and statistics

Definition 8.5 (Partial correlation) The partial correlation between \(y\) and \(z\), controlling for some variables \(\mathbf{X}\) is the sample correlation between \(y^*\) and \(z^*\), where the latter two variables are the residuals in regressions of \(y\) on \(\mathbf{X}\) and of \(z\) on \(\mathbf{X}\), respectively.

This correlation is denoted by \(r_{yz}^\mathbf{X}\). By definition, we have: \[\begin{equation} r_{yz}^\mathbf{X} = \frac{\mathbf{z^*}'\mathbf{y^*}}{\sqrt{(\mathbf{z^*}'\mathbf{z^*})(\mathbf{y^*}'\mathbf{y^*})}}.\tag{8.2} \end{equation}\]

Definition 8.6 (Skewness and kurtosis) Let \(Y\) be a random variable whose fourth moment exists. The expectation of \(Y\) is denoted by \(\mu\).

- The skewness of \(Y\) is given by: \[ \frac{\mathbb{E}[(Y-\mu)^3]}{\{\mathbb{E}[(Y-\mu)^2]\}^{3/2}}. \]

- The kurtosis of \(Y\) is given by: \[ \frac{\mathbb{E}[(Y-\mu)^4]}{\{\mathbb{E}[(Y-\mu)^2]\}^{2}}. \]

Theorem 8.1 (Cauchy-Schwarz inequality) We have: \[ |\mathbb{C}ov(X,Y)| \le \sqrt{\mathbb{V}ar(X)\mathbb{V}ar(Y)} \] and, if \(X \ne =\) and \(Y \ne 0\), the equality holds iff \(X\) and \(Y\) are the same up to an affine transformation.

Proof. If \(\mathbb{V}ar(X)=0\), this is trivial. If this is not the case, then let’s define \(Z\) as \(Z = Y - \frac{\mathbb{C}ov(X,Y)}{\mathbb{V}ar(X)}X\). It is easily seen that \(\mathbb{C}ov(X,Z)=0\). Then, the variance of \(Y=Z+\frac{\mathbb{C}ov(X,Y)}{\mathbb{V}ar(X)}X\) is equal to the sum of the variance of \(Z\) and of the variance of \(\frac{\mathbb{C}ov(X,Y)}{\mathbb{V}ar(X)}X\), that is: \[ \mathbb{V}ar(Y) = \mathbb{V}ar(Z) + \left(\frac{\mathbb{C}ov(X,Y)}{\mathbb{V}ar(X)}\right)^2\mathbb{V}ar(X) \ge \left(\frac{\mathbb{C}ov(X,Y)}{\mathbb{V}ar(X)}\right)^2\mathbb{V}ar(X). \] The equality holds iff \(\mathbb{V}ar(Z)=0\), i.e. iff \(Y = \frac{\mathbb{C}ov(X,Y)}{\mathbb{V}ar(X)}X+cst\).

Definition 8.7 (Mean ergodicity) The covariance-stationary process \(y_t\) is ergodic for the mean if: \[ \mbox{plim}_{T \rightarrow +\infty} \frac{1}{T}\sum_{t=1}^T y_t = \mathbb{E}(y_t). \]

Definition 8.8 (Second-moment ergodicity) The covariance-stationary process \(y_t\) is ergodic for second moments if, for all \(j\): \[ \mbox{plim}_{T \rightarrow +\infty} \frac{1}{T}\sum_{t=1}^T (y_t-\mu) (y_{t-j}-\mu) = \gamma_j. \]

It should be noted that ergodicity and stationarity are different properties. Typically if the process \(\{x_t\}\) is such that, \(\forall t\), \(x_t \equiv y\), where \(y \sim\,\mathcal{N}(0,1)\) (say), then \(\{x_t\}\) is stationary but not ergodic.

8.3.2 Standard distributions

Definition 8.9 (F distribution) Consider \(n=n_1+n_2\) i.i.d. \(\mathcal{N}(0,1)\) r.v. \(X_i\). If the r.v. \(F\) is defined by: \[ F = \frac{\sum_{i=1}^{n_1} X_i^2}{\sum_{j=n_1+1}^{n_1+n_2} X_j^2}\frac{n_2}{n_1} \] then \(F \sim \mathcal{F}(n_1,n_2)\). (See Table 8.4 for quantiles.)

Definition 8.10 (Student-t distribution) \(Z\) follows a Student-t (or \(t\)) distribution with \(\nu\) degrees of freedom (d.f.) if: \[ Z = X_0 \bigg/ \sqrt{\frac{\sum_{i=1}^{\nu}X_i^2}{\nu}}, \quad X_i \sim i.i.d. \mathcal{N}(0,1). \] We have \(\mathbb{E}(Z)=0\), and \(\mathbb{V}ar(Z)=\frac{\nu}{\nu-2}\) if \(\nu>2\). (See Table 8.2 for quantiles.)

Definition 8.11 (Chi-square distribution) \(Z\) follows a \(\chi^2\) distribution with \(\nu\) d.f. if \(Z = \sum_{i=1}^{\nu}X_i^2\) where \(X_i \sim i.i.d. \mathcal{N}(0,1)\). We have \(\mathbb{E}(Z)=\nu\). (See Table 8.3 for quantiles.)

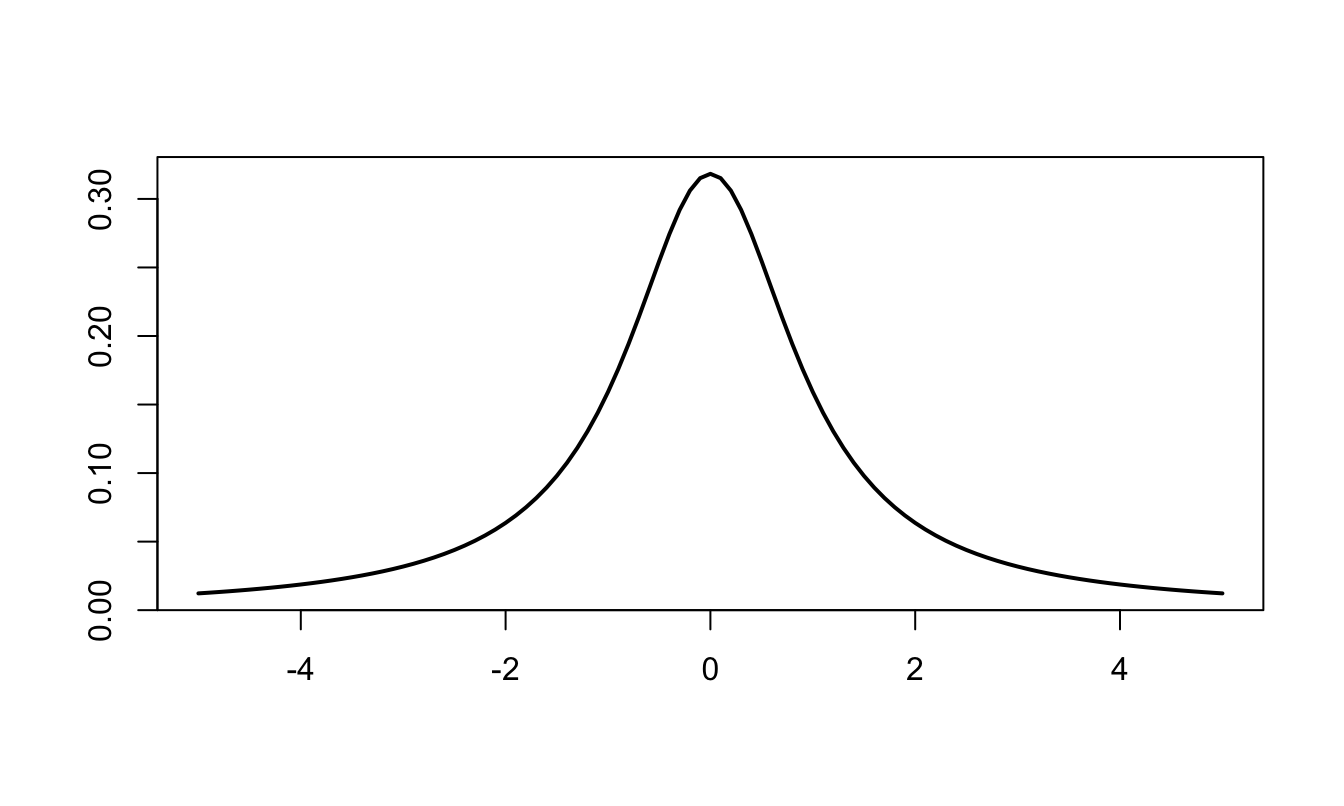

Definition 8.12 (Cauchy distribution)

The probability distribution function of the Cauchy distribution defined by a location parameter \(\mu\) and a scale parameter \(\gamma\) is: \[ f(x) = \frac{1}{\pi \gamma \left(1 + \left[\frac{x-\mu}{\gamma}\right]^2\right)}. \] The mean and variance of this distribution are undefined.

Figure 8.2: Pdf of the Cauchy distribution (\(\mu=0\), \(\gamma=1\)).

Proposition 8.9 (Inner product of a multivariate Gaussian variable) Let \(X\) be a \(n\)-dimensional multivariate Gaussian variable: \(X \sim \mathcal{N}(0,\Sigma)\). We have: \[ X' \Sigma^{-1}X \sim \chi^2(n). \]

Proof. Because \(\Sigma\) is a symmetrical definite positive matrix, it admits the spectral decomposition \(PDP'\) where \(P\) is an orthogonal matrix (i.e. \(PP'=Id\)) and D is a diagonal matrix with non-negative entries. Denoting by \(\sqrt{D^{-1}}\) the diagonal matrix whose diagonal entries are the inverse of those of \(D\), it is easily checked that the covariance matrix of \(Y:=\sqrt{D^{-1}}P'X\) is \(Id\). Therefore \(Y\) is a vector of uncorrelated Gaussian variables. The properties of Gaussian variables imply that the components of \(Y\) are then also independent. Hence \(Y'Y=\sum_i Y_i^2 \sim \chi^2(n)\).

It remains to note that \(Y'Y=X'PD^{-1}P'X=X'\mathbb{V}ar(X)^{-1}X\) to conclude.

8.3.3 Stochastic convergences

Definition 8.13 (Convergence in probability) The random variable sequence \(x_n\) converges in probability to a constant \(c\) if \(\forall \varepsilon\), \(\lim_{n \rightarrow \infty} \mathbb{P}(|x_n - c|>\varepsilon) = 0\).

It is denoted as: \(\mbox{plim } x_n = c\).

Definition 8.14 (Convergence in the Lr norm) \(x_n\) converges in the \(r\)-th mean (or in the \(L^r\)-norm) towards \(x\), if \(\mathbb{E}(|x_n|^r)\) and \(\mathbb{E}(|x|^r)\) exist and if \[ \lim_{n \rightarrow \infty} \mathbb{E}(|x_n - x|^r) = 0. \] It is denoted as: \(x_n \overset{L^r}{\rightarrow} c\).

For \(r=2\), this convergence is called mean square convergence.

Definition 8.15 (Almost sure convergence) The random variable sequence \(x_n\) converges almost surely to \(c\) if \(\mathbb{P}(\lim_{n \rightarrow \infty} x_n = c) = 1\).

It is denoted as: \(x_n \overset{a.s.}{\rightarrow} c\).

Definition 8.16 (Convergence in distribution) \(x_n\) is said to converge in distribution (or in law) to \(x\) if \[ \lim_{n \rightarrow \infty} F_{x_n}(s) = F_{x}(s) \] for all \(s\) at which \(F_X\) –the cumulative distribution of \(X\)– is continuous.

It is denoted as: \(x_n \overset{d}{\rightarrow} x\).

Theorem 8.2 (Cauchy criterion (non-stochastic case)) We have that \(\sum_{i=0}^{T} a_i\) converges (\(T \rightarrow \infty\)) iff, for any \(\eta > 0\), there exists an integer \(N\) such that, for all \(M\ge N\), \[ \left|\sum_{i=N+1}^{M} a_i\right| < \eta. \]

Theorem 8.3 (Cauchy criterion (stochastic case)) We have that \(\sum_{i=0}^{T} \theta_i \varepsilon_{t-i}\) converges in mean square (\(T \rightarrow \infty\)) to a random variable iff, for any \(\eta > 0\), there exists an integer \(N\) such that, for all \(M\ge N\), \[ \mathbb{E}\left[\left(\sum_{i=N+1}^{M} \theta_i \varepsilon_{t-i}\right)^2\right] < \eta. \]

8.3.4 Multivariate Gaussian distribution

Proposition 8.10 (p.d.f. of a multivariate Gaussian variable) If \(Y \sim \mathcal{N}(\mu,\Omega)\) and if \(Y\) is a \(n\)-dimensional vector, then the density function of \(Y\) is: \[ \frac{1}{(2 \pi)^{n/2}|\Omega|^{1/2}}\exp\left[-\frac{1}{2}\left(Y-\mu\right)'\Omega^{-1}\left(Y-\mu\right)\right]. \]

8.3.5 Central limit theorem

Theorem 8.4 (Law of large numbers) The sample mean is a consistent estimator of the population mean.

Proof. Let’s denote by \(\phi_{X_i}\) the characteristic function of a r.v. \(X_i\). If the mean of \(X_i\) is \(\mu\) then the Talyor expansion of the characteristic function is: \[ \phi_{X_i}(u) = \mathbb{E}(\exp(iuX)) = 1 + iu\mu + o(u). \] The properties of the characteristic function (see Def. ??) imply that: \[ \phi_{\frac{1}{n}(X_1+\dots+X_n)}(u) = \prod_{i=1}^{n} \left(1 + i\frac{u}{n}\mu + o\left(\frac{u}{n}\right) \right) \rightarrow e^{iu\mu}. \] The facts that (a) \(e^{iu\mu}\) is the characteristic function of the constant \(\mu\) and (b) that a characteristic function uniquely characterises a distribution imply that the sample mean converges in distribution to the constant \(\mu\), which further implies that it converges in probability to \(\mu\).

Theorem 8.5 (Lindberg-Levy Central limit theorem, CLT) If \(x_n\) is an i.i.d. sequence of random variables with mean \(\mu\) and variance \(\sigma^2\) (\(\in ]0,+\infty[\)), then: \[ \boxed{\sqrt{n} (\bar{x}_n - \mu) \overset{d}{\rightarrow} \mathcal{N}(0,\sigma^2), \quad \mbox{where} \quad \bar{x}_n = \frac{1}{n} \sum_{i=1}^{n} x_i.} \]

Proof. Let us introduce the r.v. \(Y_n:= \sqrt{n}(\bar{X}_n - \mu)\). We have \(\phi_{Y_n}(u) = \left[ \mathbb{E}\left( \exp(i \frac{1}{\sqrt{n}} u (X_1 - \mu)) \right) \right]^n\). We have: \[\begin{eqnarray*} &&\left[ \mathbb{E}\left( \exp\left(i \frac{1}{\sqrt{n}} u (X_1 - \mu)\right) \right) \right]^n\\ &=& \left[ \mathbb{E}\left( 1 + i \frac{1}{\sqrt{n}} u (X_1 - \mu) - \frac{1}{2n} u^2 (X_1 - \mu)^2 + o(u^2) \right) \right]^n \\ &=& \left( 1 - \frac{1}{2n}u^2\sigma^2 + o(u^2)\right)^n. \end{eqnarray*}\] Therefore \(\phi_{Y_n}(u) \underset{n \rightarrow \infty}{\rightarrow} \exp \left( - \frac{1}{2}u^2\sigma^2 \right)\), which is the characteristic function of \(\mathcal{N}(0,\sigma^2)\).

8.4 Proofs

Proof of Eq. (1.3)

Proof. We have: \[\begin{eqnarray*} &&T\mathbb{E}\left[(\bar{y}_T - \mu)^2\right]\\ &=& T\mathbb{E}\left[\left(\frac{1}{T}\sum_{t=1}^T(y_t - \mu)\right)^2\right] = \frac{1}{T} \mathbb{E}\left[\sum_{t=1}^T(y_t - \mu)^2+2\sum_{s<t\le T}(y_t - \mu)(y_s - \mu)\right]\\ &=& \gamma_0 +\frac{2}{T}\left(\sum_{t=2}^{T}\mathbb{E}\left[(y_t - \mu)(y_{t-1} - \mu)\right]\right) +\frac{2}{T}\left(\sum_{t=3}^{T}\mathbb{E}\left[(y_t - \mu)(y_{t-2} - \mu)\right]\right) + \dots \\ &&+ \frac{2}{T}\left(\sum_{t=T-1}^{T}\mathbb{E}\left[(y_t - \mu)(y_{t-(T-2)} - \mu)\right]\right) + \frac{2}{T}\mathbb{E}\left[(y_t - \mu)(y_{t-(T-1)} - \mu)\right]\\ &=& \gamma_0 + 2 \frac{T-1}{T}\gamma_1 + \dots + 2 \frac{1}{T}\gamma_{T-1} . \end{eqnarray*}\] Therefore: \[\begin{eqnarray*} && T\mathbb{E}\left[(\bar{y}_T - \mu)^2\right] - \sum_{j=-\infty}^{+\infty} \gamma_j \\ &=& - 2\frac{1}{T}\gamma_1 - 2\frac{2}{T}\gamma_2 - \dots - 2\frac{T-1}{T}\gamma_{T-1} - 2\gamma_T - 2 \gamma_{T+1} + \dots \end{eqnarray*}\] And then: \[\begin{eqnarray*} && \left|T\mathbb{E}\left[(\bar{y}_T - \mu)^2\right] - \sum_{j=-\infty}^{+\infty} \gamma_j\right|\\ &\le& 2\frac{1}{T}|\gamma_1| + 2\frac{2}{T}|\gamma_2| + \dots + 2\frac{T-1}{T}|\gamma_{T-1}| + 2|\gamma_T| + 2 |\gamma_{T+1}| + \dots \end{eqnarray*}\]

For any \(q \le T\), we have: \[\begin{eqnarray*} \left|T\mathbb{E}\left[(\bar{y}_T - \mu)^2\right] - \sum_{j=-\infty}^{+\infty} \gamma_j\right| &\le& 2\frac{1}{T}|\gamma_1| + 2\frac{2}{T}|\gamma_2| + \dots + 2\frac{q-1}{T}|\gamma_{q-1}| +2\frac{q}{T}|\gamma_q| +\\ &&2\frac{q+1}{T}|\gamma_{q+1}| + \dots + 2\frac{T-1}{T}|\gamma_{T-1}| + 2|\gamma_T| + 2 |\gamma_{T+1}| + \dots\\ &\le& \frac{2}{T}\left(|\gamma_1| + 2|\gamma_2| + \dots + (q-1)|\gamma_{q-1}| +q|\gamma_q|\right) +\\ &&2|\gamma_{q+1}| + \dots + 2|\gamma_{T-1}| + 2|\gamma_T| + 2 |\gamma_{T+1}| + \dots \end{eqnarray*}\]

Consider \(\varepsilon > 0\). The fact that the autocovariances are absolutely summable implies that there exists \(q_0\) such that (Cauchy criterion, Theorem 8.2): \[ 2|\gamma_{q_0+1}|+2|\gamma_{q_0+2}|+2|\gamma_{q_0+3}|+\dots < \varepsilon/2. \] Then, if \(T > q_0\), it comes that: \[ \left|T \mathbb{E}\left[(\bar{y}_T - \mu)^2\right] - \sum_{j=-\infty}^{+\infty} \gamma_j\right|\le \frac{2}{T}\left(|\gamma_1| + 2|\gamma_2| + \dots + (q_0-1)|\gamma_{q_0-1}| +q_0|\gamma_{q_0}|\right) + \varepsilon/2. \] If \(T \ge 2\left(|\gamma_1| + 2|\gamma_2| + \dots + (q_0-1)|\gamma_{q_0-1}| +q_0|\gamma_{q_0}|\right)/(\varepsilon/2)\) (\(= f(q_0)\), say) then \[ \frac{2}{T}\left(|\gamma_1| + 2|\gamma_2| + \dots + (q_0-1)|\gamma_{q_0-1}| +q_0|\gamma_{q_0}|\right) \le \varepsilon/2. \] Then, if \(T>f(q_0)\) and \(T>q_0\), i.e. if \(T>\max(f(q_0),q_0)\), we have: \[ \left|T \mathbb{E}\left[(\bar{y}_T - \mu)^2\right] - \sum_{j=-\infty}^{+\infty} \gamma_j\right|\le \varepsilon. \]

Proof of Proposition 4.1

Proof. We have: \[\begin{eqnarray} \mathbb{E}([y_{t+1} - y^*_{t+1}]^2) &=& \mathbb{E}\left([\color{blue}{\{y_{t+1} - \mathbb{E}(y_{t+1}|x_t)\}} + \color{red}{\{\mathbb{E}(y_{t+1}|x_t) - y^*_{t+1}\}}]^2\right)\nonumber\\ &=& \mathbb{E}\left(\color{blue}{[y_{t+1} - \mathbb{E}(y_{t+1}|x_t)]}^2\right) + \mathbb{E}\left(\color{red}{[\mathbb{E}(y_{t+1}|x_t) - y^*_{t+1}]}^2\right)\nonumber\\ && + 2\mathbb{E}\left( \color{blue}{[y_{t+1} - \mathbb{E}(y_{t+1}|x_t)]}\color{red}{ [\mathbb{E}(y_{t+1}|x_t) - y^*_{t+1}]}\right). \tag{8.3} \end{eqnarray}\] Let us focus on the last term. We have: \[\begin{eqnarray*} &&\mathbb{E}\left(\color{blue}{[y_{t+1} - \mathbb{E}(y_{t+1}|x_t)]}\color{red}{ [\mathbb{E}(y_{t+1}|x_t) - y^*_{t+1}]}\right)\\ &=& \mathbb{E}( \mathbb{E}( \color{blue}{[y_{t+1} - \mathbb{E}(y_{t+1}|x_t)]}\color{red}{ \underbrace{[\mathbb{E}(y_{t+1}|x_t) - y^*_{t+1}]}_{\mbox{function of $x_t$}}}|x_t))\\ &=& \mathbb{E}( \color{red}{ [\mathbb{E}(y_{t+1}|x_t) - y^*_{t+1}]} \mathbb{E}( \color{blue}{[y_{t+1} - \mathbb{E}(y_{t+1}|x_t)]}|x_t))\\ &=& \mathbb{E}( \color{red}{ [\mathbb{E}(y_{t+1}|x_t) - y^*_{t+1}]} \color{blue}{\underbrace{[\mathbb{E}(y_{t+1}|x_t) - \mathbb{E}(y_{t+1}|x_t)]}_{=0}})=0. \end{eqnarray*}\]

Therefore, Eq. (8.3) becomes: \[\begin{eqnarray*} &&\mathbb{E}([y_{t+1} - y^*_{t+1}]^2) \\ &=& \underbrace{\mathbb{E}\left(\color{blue}{[y_{t+1} - \mathbb{E}(y_{t+1}|x_t)]}^2\right)}_{\mbox{$\ge 0$ and does not depend on $y^*_{t+1}$}} + \underbrace{\mathbb{E}\left(\color{red}{[\mathbb{E}(y_{t+1}|x_t) - y^*_{t+1}]}^2\right)}_{\mbox{$\ge 0$ and depends on $y^*_{t+1}$}}. \end{eqnarray*}\] This implies that \(\mathbb{E}([y_{t+1} - y^*_{t+1}]^2)\) is always larger than \(\color{blue}{\mathbb{E}([y_{t+1} - \mathbb{E}(y_{t+1}|x_t)]^2)}\), and is therefore minimized if the second term is equal to zero, that is if \(\mathbb{E}(y_{t+1}|x_t) = y^*_{t+1}\).

Proof of Proposition 3.1

Proof. Using Proposition ??, we obtain that, conditionally on \(x_1\), the log-likelihood is given by \[\begin{eqnarray*} \log\mathcal{L}(Y_{T};\theta) & = & -(Tn/2)\log(2\pi)+(T/2)\log\left|\Omega^{-1}\right|\\ & & -\frac{1}{2}\sum_{t=1}^{T}\left[\left(y_{t}-\Pi'x_{t}\right)'\Omega^{-1}\left(y_{t}-\Pi'x_{t}\right)\right]. \end{eqnarray*}\] Let’s rewrite the last term of the log-likelihood: \[\begin{eqnarray*} \sum_{t=1}^{T}\left[\left(y_{t}-\Pi'x_{t}\right)'\Omega^{-1}\left(y_{t}-\Pi'x_{t}\right)\right] & =\\ \sum_{t=1}^{T}\left[\left(y_{t}-\hat{\Pi}'x_{t}+\hat{\Pi}'x_{t}-\Pi'x_{t}\right)'\Omega^{-1}\left(y_{t}-\hat{\Pi}'x_{t}+\hat{\Pi}'x_{t}-\Pi'x_{t}\right)\right] & =\\ \sum_{t=1}^{T}\left[\left(\hat{\varepsilon}_{t}+(\hat{\Pi}-\Pi)'x_{t}\right)'\Omega^{-1}\left(\hat{\varepsilon}_{t}+(\hat{\Pi}-\Pi)'x_{t}\right)\right], \end{eqnarray*}\] where the \(j^{th}\) element of the \((n\times1)\) vector \(\hat{\varepsilon}_{t}\) is the sample residual, for observation \(t\), from an OLS regression of \(y_{j,t}\) on \(x_{t}\). Expanding the previous equation, we get: \[\begin{eqnarray*} &&\sum_{t=1}^{T}\left[\left(y_{t}-\Pi'x_{t}\right)'\Omega^{-1}\left(y_{t}-\Pi'x_{t}\right)\right] = \sum_{t=1}^{T}\hat{\varepsilon}_{t}'\Omega^{-1}\hat{\varepsilon}_{t}\\ &&+2\sum_{t=1}^{T}\hat{\varepsilon}_{t}'\Omega^{-1}(\hat{\Pi}-\Pi)'x_{t}+\sum_{t=1}^{T}x'_{t}(\hat{\Pi}-\Pi)\Omega^{-1}(\hat{\Pi}-\Pi)'x_{t}. \end{eqnarray*}\] Let’s apply the trace operator on the second term (that is a scalar): \[\begin{eqnarray*} \sum_{t=1}^{T}\hat{\varepsilon}_{t}'\Omega^{-1}(\hat{\Pi}-\Pi)'x_{t} & = & Tr\left(\sum_{t=1}^{T}\hat{\varepsilon}_{t}'\Omega^{-1}(\hat{\Pi}-\Pi)'x_{t}\right)\\ = Tr\left(\sum_{t=1}^{T}\Omega^{-1}(\hat{\Pi}-\Pi)'x_{t}\hat{\varepsilon}_{t}'\right) & = & Tr\left(\Omega^{-1}(\hat{\Pi}-\Pi)'\sum_{t=1}^{T}x_{t}\hat{\varepsilon}_{t}'\right). \end{eqnarray*}\] Given that, by construction (property of OLS estimates), the sample residuals are orthogonal to the explanatory variables, this term is zero. Introducing \(\tilde{x}_{t}=(\hat{\Pi}-\Pi)'x_{t}\), we have \[\begin{eqnarray*} \sum_{t=1}^{T}\left[\left(y_{t}-\Pi'x_{t}\right)'\Omega^{-1}\left(y_{t}-\Pi'x_{t}\right)\right] =\sum_{t=1}^{T}\hat{\varepsilon}_{t}'\Omega^{-1}\hat{\varepsilon}_{t}+\sum_{t=1}^{T}\tilde{x}'_{t}\Omega^{-1}\tilde{x}_{t}. \end{eqnarray*}\] Since \(\Omega\) is a positive definite matrix, \(\Omega^{-1}\) is as well. Consequently, the smallest value that the last term can take is obtained for \(\tilde{x}_{t}=0\), i.e. when \(\Pi=\hat{\Pi}.\)

The MLE of \(\Omega\) is the matrix \(\hat{\Omega}\) that maximizes \(\Omega\overset{\ell}{\rightarrow}L(Y_{T};\hat{\Pi},\Omega)\). We have: \[\begin{eqnarray*} \log\mathcal{L}(Y_{T};\hat{\Pi},\Omega) & = & -(Tn/2)\log(2\pi)+(T/2)\log\left|\Omega^{-1}\right| -\frac{1}{2}\sum_{t=1}^{T}\left[\hat{\varepsilon}_{t}'\Omega^{-1}\hat{\varepsilon}_{t}\right]. \end{eqnarray*}\]

Matrix \(\hat{\Omega}\) is a symmetric positive definite. It is easily checked that the (unrestricted) matrix that maximizes the latter expression is symmetric positive definite matrix. Indeed: \[ \frac{\partial \log\mathcal{L}(Y_{T};\hat{\Pi},\Omega)}{\partial\Omega}=\frac{T}{2}\Omega'-\frac{1}{2}\sum_{t=1}^{T}\hat{\varepsilon}_{t}\hat{\varepsilon}'_{t}\Rightarrow\hat{\Omega}'=\frac{1}{T}\sum_{t=1}^{T}\hat{\varepsilon}_{t}\hat{\varepsilon}'_{t}, \] which leads to the result.

Proof of Proposition 3.2

Proof. Let us drop the \(i\) subscript. Rearranging Eq. (2.19), we have: \[ \sqrt{T}(\mathbf{b}-\boldsymbol{\beta}) = (X'X/T)^{-1}\sqrt{T}(X'\boldsymbol\varepsilon/T). \] Let us consider the autocovariances of \(\mathbf{v}_t = x_t \varepsilon_t\), denoted by \(\gamma^v_j\). Using the fact that \(x_t\) is a linear combination of past \(\varepsilon_t\)s and that \(\varepsilon_t\) is a white noise, we get that \(\mathbb{E}(\varepsilon_t x_t)=0\). Therefore \[ \gamma^v_j = \mathbb{E}(\varepsilon_t\varepsilon_{t-j}x_tx_{t-j}'). \] If \(j>0\), we have \(\mathbb{E}(\varepsilon_t\varepsilon_{t-j}x_tx_{t-j}')=\mathbb{E}(\mathbb{E}[\varepsilon_t\varepsilon_{t-j}x_tx_{t-j}'|\varepsilon_{t-j},x_t,x_{t-j}])=\) \(\mathbb{E}(\varepsilon_{t-j}x_tx_{t-j}'\mathbb{E}[\varepsilon_t|\varepsilon_{t-j},x_t,x_{t-j}])=0\). Note that we have \(\mathbb{E}[\varepsilon_t|\varepsilon_{t-j},x_t,x_{t-j}]=0\) because \(\{\varepsilon_t\}\) is an i.i.d. white noise sequence. If \(j=0\), we have: \[ \gamma^v_0 = \mathbb{E}(\varepsilon_t^2x_tx_{t}')= \mathbb{E}(\varepsilon_t^2) \mathbb{E}(x_tx_{t}')=\sigma^2\mathbf{Q}. \] The convergence in distribution of \(\sqrt{T}(X'\boldsymbol\varepsilon/T)=\sqrt{T}\frac{1}{T}\sum_{t=1}^Tv_t\) results from the Central Limit Theorem for covariance-stationary processes, using the \(\gamma_j^v\) computed above.

8.5 Inference

8.5.1 Monte Carlo method

We use Monte Carlo when we need to approximate the distribution of a variable whose distribution is unknown but which is a function of another variable whose distribution is known. For instance, suppose we know the distribution of a random variable \(X\), which takes values in \(\mathbb{R}\), with density function \(p\). Assume we want to compute the mean of \(\varphi(X)\). We have: \[ \mathbb{E}(\varphi(X))=\int_{-\infty}^{+\infty}\varphi(x)p(x)dx \] Suppose that the above integral does not have a simple expression. We cannot compute \(\mathbb{E}(\varphi(X))\) but, by virtue of the law of large numbers, we can approximate it as follows: \[ \mathbb{E}(\varphi(X))\approx\frac{1}{N}\sum_{i=1}^N\varphi(X^{(i)}), \] where \(\{X^{(i)}\}_{i=1,...,N}\) are \(N\) independent draws of \(X\). More generally, the distribution of \(\varphi(X)\) can be approximated by the empirical distribution of the \(\varphi(X^{(i)})\)’s. Typically, if 10’000 values of \(\varphi(X^{(i)})\) are drawn, the \(5^{th}\) percentile of the p.d.f. of \(\varphi(X)\) can be approximated by the \(500^{th}\) value of the 10’000 draws of \(\varphi(X^{(i)})\) (after arranging these values in ascending order).

For instance, as regards the computation of confidence intervals around IRFs, one has to think of \(\{\widehat{\Phi}_j\}_{j=1,...,p}\), and of \(\widehat{\Omega}\) as \(X\) and \(\{\widehat{\Psi}_j\}_{j=1,...}\) as \(\varphi(X)\). (Proposition 3.3 provides us with the asymptotic distribution of the “\(X\).”)

To summarize, here are the steps one can implement to derive confidence intervals for the IRFs using the Monte-Carlo approach: For each iteration \(k\),

- Draw \(\{\widehat{\Phi}_j^{(k)}\}_{j=1,...,p}\) and \(\widehat{\Omega}^{(k)}\) from their asymptotic distribution (using Proposition 3.3).

- Compute the matrix \(B^{(k)}\) so that \(\widehat{\Omega}^{(k)}=B^{(k)}B^{(k)'}\), according to your identification strategy.

- Compute the associated IRFs \(\{\widehat{\Psi}_j\}^{(k)}\).

Perform \(N\) replications and report the median impulse response (and its confidence intervals).

8.5.2 Delta method

Suppose \(\beta\) is a vector of parameters and \(\beta\) is an estimator such that \[ \sqrt{T}(\hat\beta-\beta)\overset{d}{\rightarrow}\mathcal{N}(0,\Sigma_\beta), \] where \(d\) denotes convergence in distribution, \(N(0,\Sigma_\beta)\) denotes the multivariate normal distribution with mean vector 0 and covariance matrix \(\Sigma_\beta\) and \(T\) is the sample size used for estimation.

Let \(g(\beta) = (g_l(\beta),..., g_m(\beta))'\) be a continuously differentiable function with values in \(\mathbb{R}^m\), and assume that \(\partial g_i/\partial \beta' = (\partial g_i/\partial \beta_j)\) is nonzero at \(\beta\) for \(i = 1,\dots, m\). Then \[ \sqrt{T}(g(\hat\beta)-g(\beta))\overset{d}{\rightarrow}\mathcal{N}\left(0,\frac{\partial g}{\partial \beta'}\Sigma_\beta\frac{\partial g'}{\partial \beta}\right). \] Using this property, Lütkepohl (1990) provides the asymptotic distributions of the \(\Psi_j\)’s. The following lines of code can be used to get approximate confidence intervals for IRFs.

irf.function <- function(THETA){

c <- THETA[1]

phi <- THETA[2:(p+1)]

if(q>0){

theta <- c(1,THETA[(1+p+1):(1+p+q)])

}else{theta <- 1}

sigma <- THETA[1+p+q+1]

r <- dim(Matrix.of.Exog)[2] - 1

beta <- THETA[(1+p+q+1+1):(1+p+q+1+(r+1))]

irf <- sim.arma(0,phi,beta,sigma=sd(Ramey$ED3_TC,na.rm=TRUE),T=60,

y.0=rep(0,length(x$phi)),nb.sim=1,make.IRF=1,

X=NaN,beta=NaN)

return(irf)}

IRF.0 <- 100*irf.function(x$THETA)

eps <- .00000001

d.IRF <- NULL

for(i in 1:length(x$THETA)){

THETA.i <- x$THETA

THETA.i[i] <- THETA.i[i] + eps

IRF.i <- 100*irf.function(THETA.i)

d.IRF <- cbind(d.IRF,

(IRF.i - IRF.0)/eps)}

mat.var.cov.IRF <- d.IRF %*% x$I %*% t(d.IRF)A limit of the last two approaches (Monte Carlo and the Delta method) is that they rely on asymptotic results. Boostrapping approaches are more robust in small-sample situations.

8.5.3 Bootstrap

IRFs’ confidence intervals are intervals where 90% (or 95%, 75%, …) of the IRFs would lie, if we were to repeat the estimation a large number of times in similar conditions (\(T\) observations). We obviously cannot do this, because we have only one sample: \(\{y_t\}_{t=1,..,T}\). But we can try to construct such samples.

Bootstrapping consists in:

- re-sampling \(N\) times, i.e., constructing \(N\) samples of \(T\) observations, using the estimated VAR coefficients and

- a sample of residuals from the distribution \(N(0,BB')\) (parametric approach), or

- a sample of residuals drawn randomly from the set of the actual estimated residuals \(\{\hat\varepsilon_t\}_{t=1,..,T}\). (non-parametric approach).

- re-estimating the SVAR \(N\) times.

Here is the algorithm:

- Construct a sample \[ y_t^{(k)}=\widehat{\Phi}_1 y_{t-1}^{(k)} + \dots + \widehat{\Phi}_p y_{t-p}^{(k)} + \hat\varepsilon_t^{(k)}, \] with \(\hat\varepsilon_{t}^{(k)}=\hat\varepsilon_{s_t^{(k)}}\), where \(\{s_1^{(k)},..,s_T^{(k)}\}\) is a random set from \(\{1,..,T\}^T\).

- Re-estimate the SVAR and compute the IRFs \(\{\widehat{\Psi}_j\}^{(k)}\).

Perform \(N\) replications and report the median impulse response (and its confidence intervals).

8.6 Statistical Tables

| 0 | 0.01 | 0.02 | 0.03 | 0.04 | 0.05 | 0.06 | 0.07 | 0.08 | 0.09 | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.5000 | 0.6179 | 0.7257 | 0.8159 | 0.8849 | 0.9332 | 0.9641 | 0.9821 | 0.9918 | 0.9965 |

| 0.1 | 0.5040 | 0.6217 | 0.7291 | 0.8186 | 0.8869 | 0.9345 | 0.9649 | 0.9826 | 0.9920 | 0.9966 |

| 0.2 | 0.5080 | 0.6255 | 0.7324 | 0.8212 | 0.8888 | 0.9357 | 0.9656 | 0.9830 | 0.9922 | 0.9967 |

| 0.3 | 0.5120 | 0.6293 | 0.7357 | 0.8238 | 0.8907 | 0.9370 | 0.9664 | 0.9834 | 0.9925 | 0.9968 |

| 0.4 | 0.5160 | 0.6331 | 0.7389 | 0.8264 | 0.8925 | 0.9382 | 0.9671 | 0.9838 | 0.9927 | 0.9969 |

| 0.5 | 0.5199 | 0.6368 | 0.7422 | 0.8289 | 0.8944 | 0.9394 | 0.9678 | 0.9842 | 0.9929 | 0.9970 |

| 0.6 | 0.5239 | 0.6406 | 0.7454 | 0.8315 | 0.8962 | 0.9406 | 0.9686 | 0.9846 | 0.9931 | 0.9971 |

| 0.7 | 0.5279 | 0.6443 | 0.7486 | 0.8340 | 0.8980 | 0.9418 | 0.9693 | 0.9850 | 0.9932 | 0.9972 |

| 0.8 | 0.5319 | 0.6480 | 0.7517 | 0.8365 | 0.8997 | 0.9429 | 0.9699 | 0.9854 | 0.9934 | 0.9973 |

| 0.9 | 0.5359 | 0.6517 | 0.7549 | 0.8389 | 0.9015 | 0.9441 | 0.9706 | 0.9857 | 0.9936 | 0.9974 |

| 1 | 0.5398 | 0.6554 | 0.7580 | 0.8413 | 0.9032 | 0.9452 | 0.9713 | 0.9861 | 0.9938 | 0.9974 |

| 1.1 | 0.5438 | 0.6591 | 0.7611 | 0.8438 | 0.9049 | 0.9463 | 0.9719 | 0.9864 | 0.9940 | 0.9975 |

| 1.2 | 0.5478 | 0.6628 | 0.7642 | 0.8461 | 0.9066 | 0.9474 | 0.9726 | 0.9868 | 0.9941 | 0.9976 |

| 1.3 | 0.5517 | 0.6664 | 0.7673 | 0.8485 | 0.9082 | 0.9484 | 0.9732 | 0.9871 | 0.9943 | 0.9977 |

| 1.4 | 0.5557 | 0.6700 | 0.7704 | 0.8508 | 0.9099 | 0.9495 | 0.9738 | 0.9875 | 0.9945 | 0.9977 |

| 1.5 | 0.5596 | 0.6736 | 0.7734 | 0.8531 | 0.9115 | 0.9505 | 0.9744 | 0.9878 | 0.9946 | 0.9978 |

| 1.6 | 0.5636 | 0.6772 | 0.7764 | 0.8554 | 0.9131 | 0.9515 | 0.9750 | 0.9881 | 0.9948 | 0.9979 |

| 1.7 | 0.5675 | 0.6808 | 0.7794 | 0.8577 | 0.9147 | 0.9525 | 0.9756 | 0.9884 | 0.9949 | 0.9979 |

| 1.8 | 0.5714 | 0.6844 | 0.7823 | 0.8599 | 0.9162 | 0.9535 | 0.9761 | 0.9887 | 0.9951 | 0.9980 |

| 1.9 | 0.5753 | 0.6879 | 0.7852 | 0.8621 | 0.9177 | 0.9545 | 0.9767 | 0.9890 | 0.9952 | 0.9981 |

| 2 | 0.5793 | 0.6915 | 0.7881 | 0.8643 | 0.9192 | 0.9554 | 0.9772 | 0.9893 | 0.9953 | 0.9981 |

| 2.1 | 0.5832 | 0.6950 | 0.7910 | 0.8665 | 0.9207 | 0.9564 | 0.9778 | 0.9896 | 0.9955 | 0.9982 |

| 2.2 | 0.5871 | 0.6985 | 0.7939 | 0.8686 | 0.9222 | 0.9573 | 0.9783 | 0.9898 | 0.9956 | 0.9982 |

| 2.3 | 0.5910 | 0.7019 | 0.7967 | 0.8708 | 0.9236 | 0.9582 | 0.9788 | 0.9901 | 0.9957 | 0.9983 |

| 2.4 | 0.5948 | 0.7054 | 0.7995 | 0.8729 | 0.9251 | 0.9591 | 0.9793 | 0.9904 | 0.9959 | 0.9984 |

| 2.5 | 0.5987 | 0.7088 | 0.8023 | 0.8749 | 0.9265 | 0.9599 | 0.9798 | 0.9906 | 0.9960 | 0.9984 |

| 2.6 | 0.6026 | 0.7123 | 0.8051 | 0.8770 | 0.9279 | 0.9608 | 0.9803 | 0.9909 | 0.9961 | 0.9985 |

| 2.7 | 0.6064 | 0.7157 | 0.8078 | 0.8790 | 0.9292 | 0.9616 | 0.9808 | 0.9911 | 0.9962 | 0.9985 |

| 2.8 | 0.6103 | 0.7190 | 0.8106 | 0.8810 | 0.9306 | 0.9625 | 0.9812 | 0.9913 | 0.9963 | 0.9986 |

| 2.9 | 0.6141 | 0.7224 | 0.8133 | 0.8830 | 0.9319 | 0.9633 | 0.9817 | 0.9916 | 0.9964 | 0.9986 |

| 0.05 | 0.1 | 0.75 | 0.9 | 0.95 | 0.975 | 0.99 | 0.999 | |

|---|---|---|---|---|---|---|---|---|

| 1 | 0.079 | 0.158 | 2.414 | 6.314 | 12.706 | 25.452 | 63.657 | 636.619 |

| 2 | 0.071 | 0.142 | 1.604 | 2.920 | 4.303 | 6.205 | 9.925 | 31.599 |

| 3 | 0.068 | 0.137 | 1.423 | 2.353 | 3.182 | 4.177 | 5.841 | 12.924 |

| 4 | 0.067 | 0.134 | 1.344 | 2.132 | 2.776 | 3.495 | 4.604 | 8.610 |

| 5 | 0.066 | 0.132 | 1.301 | 2.015 | 2.571 | 3.163 | 4.032 | 6.869 |

| 6 | 0.065 | 0.131 | 1.273 | 1.943 | 2.447 | 2.969 | 3.707 | 5.959 |

| 7 | 0.065 | 0.130 | 1.254 | 1.895 | 2.365 | 2.841 | 3.499 | 5.408 |

| 8 | 0.065 | 0.130 | 1.240 | 1.860 | 2.306 | 2.752 | 3.355 | 5.041 |

| 9 | 0.064 | 0.129 | 1.230 | 1.833 | 2.262 | 2.685 | 3.250 | 4.781 |

| 10 | 0.064 | 0.129 | 1.221 | 1.812 | 2.228 | 2.634 | 3.169 | 4.587 |

| 20 | 0.063 | 0.127 | 1.185 | 1.725 | 2.086 | 2.423 | 2.845 | 3.850 |

| 30 | 0.063 | 0.127 | 1.173 | 1.697 | 2.042 | 2.360 | 2.750 | 3.646 |

| 40 | 0.063 | 0.126 | 1.167 | 1.684 | 2.021 | 2.329 | 2.704 | 3.551 |

| 50 | 0.063 | 0.126 | 1.164 | 1.676 | 2.009 | 2.311 | 2.678 | 3.496 |

| 60 | 0.063 | 0.126 | 1.162 | 1.671 | 2.000 | 2.299 | 2.660 | 3.460 |

| 70 | 0.063 | 0.126 | 1.160 | 1.667 | 1.994 | 2.291 | 2.648 | 3.435 |

| 80 | 0.063 | 0.126 | 1.159 | 1.664 | 1.990 | 2.284 | 2.639 | 3.416 |

| 90 | 0.063 | 0.126 | 1.158 | 1.662 | 1.987 | 2.280 | 2.632 | 3.402 |

| 100 | 0.063 | 0.126 | 1.157 | 1.660 | 1.984 | 2.276 | 2.626 | 3.390 |

| 200 | 0.063 | 0.126 | 1.154 | 1.653 | 1.972 | 2.258 | 2.601 | 3.340 |

| 500 | 0.063 | 0.126 | 1.152 | 1.648 | 1.965 | 2.248 | 2.586 | 3.310 |

| 0.05 | 0.1 | 0.75 | 0.9 | 0.95 | 0.975 | 0.99 | 0.999 | |

|---|---|---|---|---|---|---|---|---|

| 1 | 0.004 | 0.016 | 1.323 | 2.706 | 3.841 | 5.024 | 6.635 | 10.828 |

| 2 | 0.103 | 0.211 | 2.773 | 4.605 | 5.991 | 7.378 | 9.210 | 13.816 |

| 3 | 0.352 | 0.584 | 4.108 | 6.251 | 7.815 | 9.348 | 11.345 | 16.266 |

| 4 | 0.711 | 1.064 | 5.385 | 7.779 | 9.488 | 11.143 | 13.277 | 18.467 |

| 5 | 1.145 | 1.610 | 6.626 | 9.236 | 11.070 | 12.833 | 15.086 | 20.515 |

| 6 | 1.635 | 2.204 | 7.841 | 10.645 | 12.592 | 14.449 | 16.812 | 22.458 |

| 7 | 2.167 | 2.833 | 9.037 | 12.017 | 14.067 | 16.013 | 18.475 | 24.322 |

| 8 | 2.733 | 3.490 | 10.219 | 13.362 | 15.507 | 17.535 | 20.090 | 26.124 |

| 9 | 3.325 | 4.168 | 11.389 | 14.684 | 16.919 | 19.023 | 21.666 | 27.877 |

| 10 | 3.940 | 4.865 | 12.549 | 15.987 | 18.307 | 20.483 | 23.209 | 29.588 |

| 20 | 10.851 | 12.443 | 23.828 | 28.412 | 31.410 | 34.170 | 37.566 | 45.315 |

| 30 | 18.493 | 20.599 | 34.800 | 40.256 | 43.773 | 46.979 | 50.892 | 59.703 |

| 40 | 26.509 | 29.051 | 45.616 | 51.805 | 55.758 | 59.342 | 63.691 | 73.402 |

| 50 | 34.764 | 37.689 | 56.334 | 63.167 | 67.505 | 71.420 | 76.154 | 86.661 |

| 60 | 43.188 | 46.459 | 66.981 | 74.397 | 79.082 | 83.298 | 88.379 | 99.607 |

| 70 | 51.739 | 55.329 | 77.577 | 85.527 | 90.531 | 95.023 | 100.425 | 112.317 |

| 80 | 60.391 | 64.278 | 88.130 | 96.578 | 101.879 | 106.629 | 112.329 | 124.839 |

| 90 | 69.126 | 73.291 | 98.650 | 107.565 | 113.145 | 118.136 | 124.116 | 137.208 |

| 100 | 77.929 | 82.358 | 109.141 | 118.498 | 124.342 | 129.561 | 135.807 | 149.449 |

| 200 | 168.279 | 174.835 | 213.102 | 226.021 | 233.994 | 241.058 | 249.445 | 267.541 |

| 500 | 449.147 | 459.926 | 520.950 | 540.930 | 553.127 | 563.852 | 576.493 | 603.446 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| alpha = 0.9 | ||||||||||

| 5 | 4.060 | 3.780 | 3.619 | 3.520 | 3.453 | 3.405 | 3.368 | 3.339 | 3.316 | 3.297 |

| 10 | 3.285 | 2.924 | 2.728 | 2.605 | 2.522 | 2.461 | 2.414 | 2.377 | 2.347 | 2.323 |

| 15 | 3.073 | 2.695 | 2.490 | 2.361 | 2.273 | 2.208 | 2.158 | 2.119 | 2.086 | 2.059 |

| 20 | 2.975 | 2.589 | 2.380 | 2.249 | 2.158 | 2.091 | 2.040 | 1.999 | 1.965 | 1.937 |

| 50 | 2.809 | 2.412 | 2.197 | 2.061 | 1.966 | 1.895 | 1.840 | 1.796 | 1.760 | 1.729 |

| 100 | 2.756 | 2.356 | 2.139 | 2.002 | 1.906 | 1.834 | 1.778 | 1.732 | 1.695 | 1.663 |

| 500 | 2.716 | 2.313 | 2.095 | 1.956 | 1.859 | 1.786 | 1.729 | 1.683 | 1.644 | 1.612 |

| alpha = 0.95 | ||||||||||

| 5 | 6.608 | 5.786 | 5.409 | 5.192 | 5.050 | 4.950 | 4.876 | 4.818 | 4.772 | 4.735 |

| 10 | 4.965 | 4.103 | 3.708 | 3.478 | 3.326 | 3.217 | 3.135 | 3.072 | 3.020 | 2.978 |

| 15 | 4.543 | 3.682 | 3.287 | 3.056 | 2.901 | 2.790 | 2.707 | 2.641 | 2.588 | 2.544 |

| 20 | 4.351 | 3.493 | 3.098 | 2.866 | 2.711 | 2.599 | 2.514 | 2.447 | 2.393 | 2.348 |

| 50 | 4.034 | 3.183 | 2.790 | 2.557 | 2.400 | 2.286 | 2.199 | 2.130 | 2.073 | 2.026 |

| 100 | 3.936 | 3.087 | 2.696 | 2.463 | 2.305 | 2.191 | 2.103 | 2.032 | 1.975 | 1.927 |

| 500 | 3.860 | 3.014 | 2.623 | 2.390 | 2.232 | 2.117 | 2.028 | 1.957 | 1.899 | 1.850 |

| alpha = 0.99 | ||||||||||

| 5 | 16.258 | 13.274 | 12.060 | 11.392 | 10.967 | 10.672 | 10.456 | 10.289 | 10.158 | 10.051 |

| 10 | 10.044 | 7.559 | 6.552 | 5.994 | 5.636 | 5.386 | 5.200 | 5.057 | 4.942 | 4.849 |

| 15 | 8.683 | 6.359 | 5.417 | 4.893 | 4.556 | 4.318 | 4.142 | 4.004 | 3.895 | 3.805 |

| 20 | 8.096 | 5.849 | 4.938 | 4.431 | 4.103 | 3.871 | 3.699 | 3.564 | 3.457 | 3.368 |

| 50 | 7.171 | 5.057 | 4.199 | 3.720 | 3.408 | 3.186 | 3.020 | 2.890 | 2.785 | 2.698 |

| 100 | 6.895 | 4.824 | 3.984 | 3.513 | 3.206 | 2.988 | 2.823 | 2.694 | 2.590 | 2.503 |

| 500 | 6.686 | 4.648 | 3.821 | 3.357 | 3.054 | 2.838 | 2.675 | 2.547 | 2.443 | 2.356 |